The target of this discussion is to examine a few of the truths and myths of property planning. A variety of posts have been written about the topic but let us see if we can not put another twist on it by keeping it easy. By dispelling some of the common misconceptions, we'll get a better knowledge of how important it's to take positive actions to maintain our real estate plans in order. If you want to take the services of perfect estate planning in attorney mesa az then you may search online.

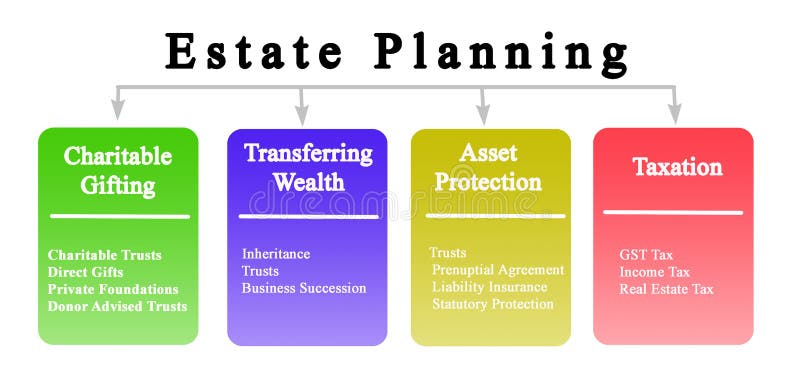

Image Source: Google

The Economic Growth and Tax Reconciliation Relief Act of 2001 (EGTRRA) drove many people for a loop in regards to estate planning. Tax laws are not straightforward however EGTRRA added a degree of confusion seldom seen in advanced planning.

Myth. The Federal Estate Tax was repealed.

The passing of the 2001 EGTRRA provided invaluable estate tax breaks. Due to the peculiar manner in which the legislation has been written, the Economic Growth and Tax Relief Reconciliation Act gave some people a false sense of safety by directing them to think that the federal estate tax has been repealed in 2001.

The truth is that the present tax legislation repeals the federal estate taxation for just 1 year, 2010. Based upon the year of departure, the estate tax amount, the corresponding exclusion amount (that is the sum which each individual has the capacity to pass to beneficiaries free of federal estate taxation ) along with the best tax rate change significantly.

Permanent repeal of the federal estate taxation demands a positive vote of 60 Senators. This isn't a simple job. In the end, repealing the federal estate could eliminate a substantial source of national revenue.